This is a day that both we and our members have been looking forward to. Today we are honored to bring you an updated signals service, from our Tools Trades team!

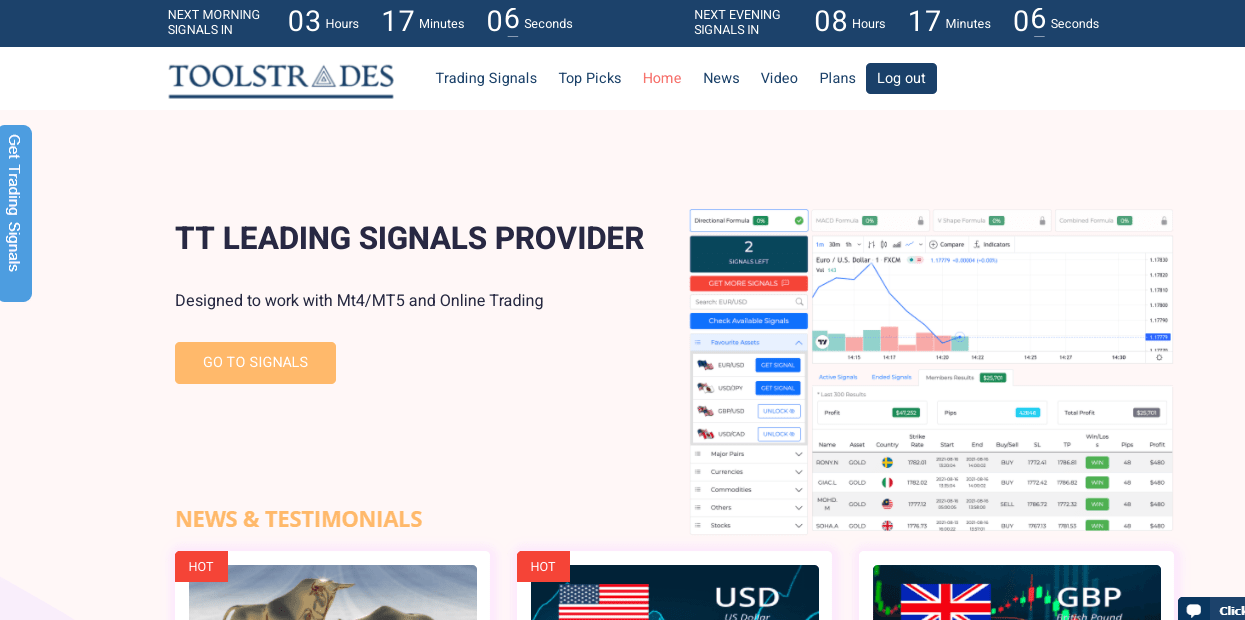

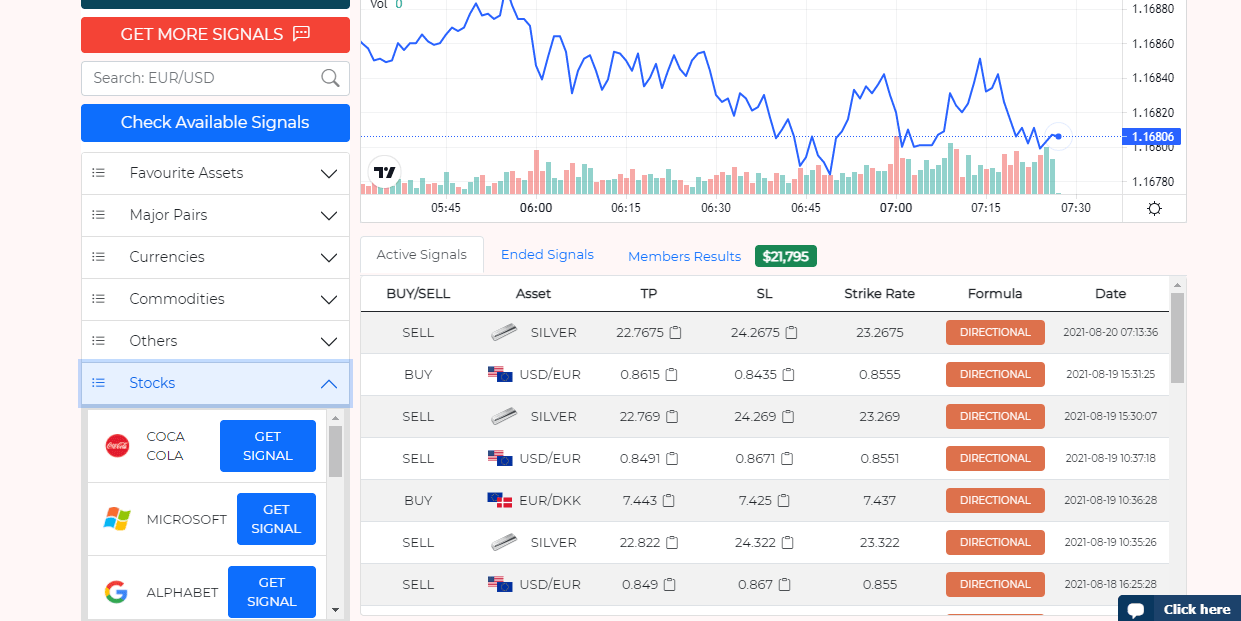

Design

You can see the updated design, which has also positively affected the usability of the service.

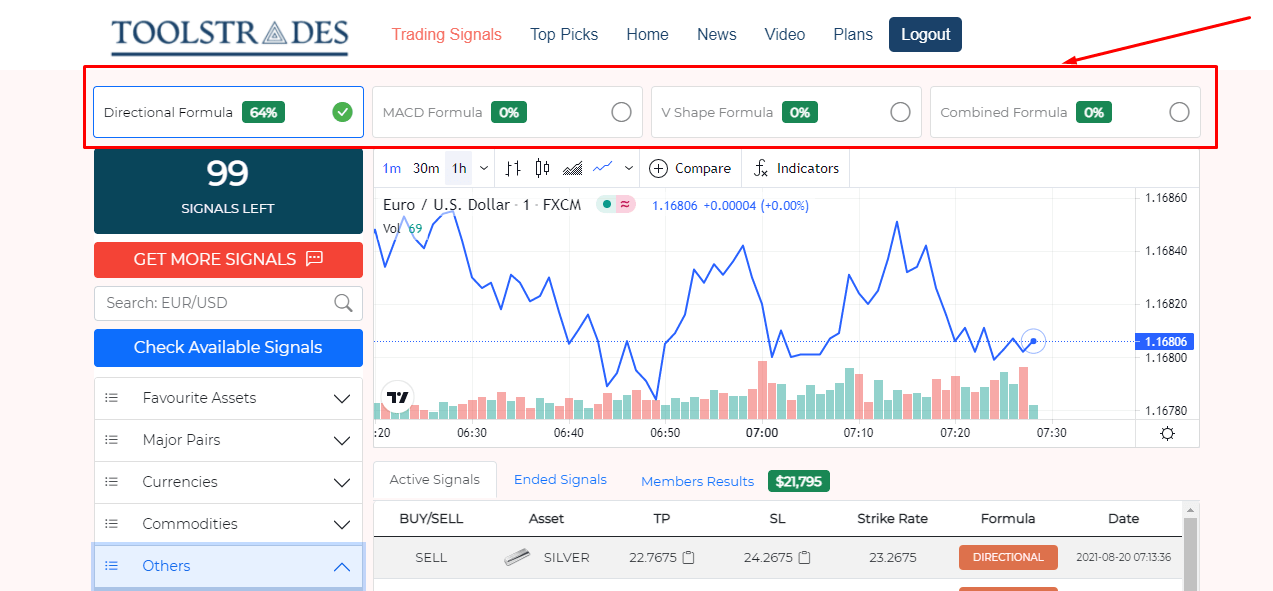

New Formulas

The innovations related to the functionality expansion and new features for our members affected many areas. For example, now 3 new formulas for trade analysis are available for our members. We have added three new formulas to the Artificial Intelligence calculation algorithms of our service which we have been developing for more than 8 years. This will enable you to get even more accurate data for your trades and be more successful with the updated version of our service.

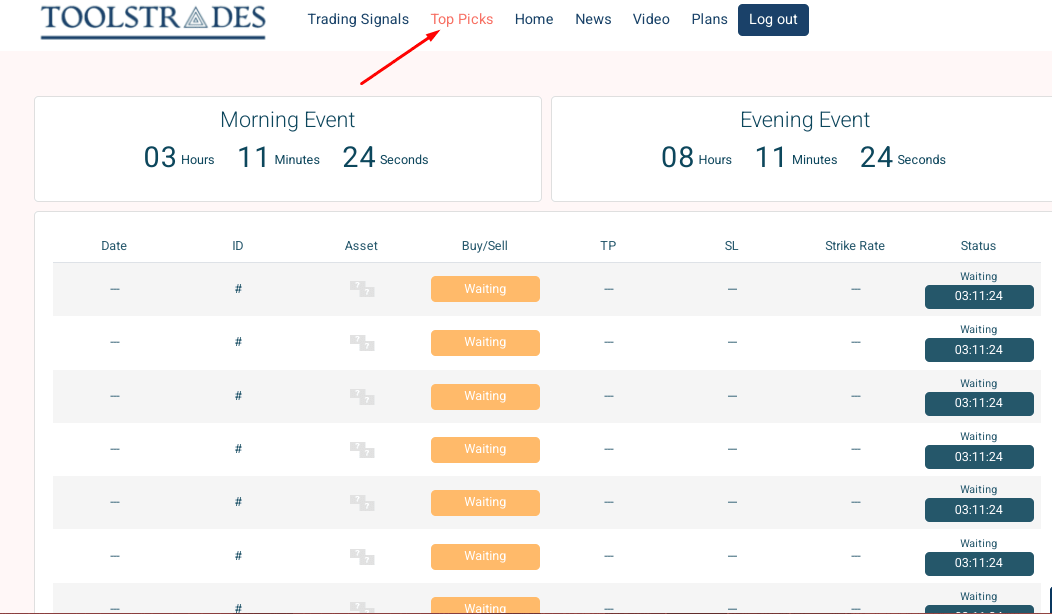

Top Picks

We've added a list of recommended assets that is updated twice a day. Our members can use this benchmark to adjust their investment portfolios and have flexibility within rapidly changing markets.

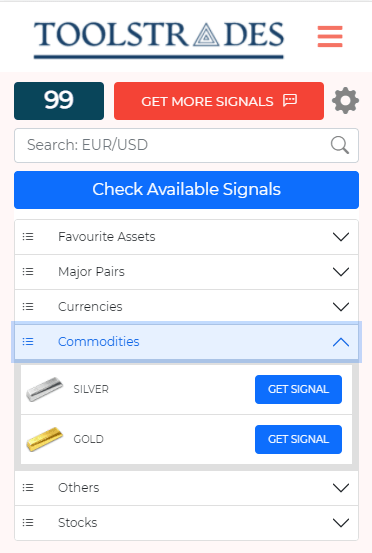

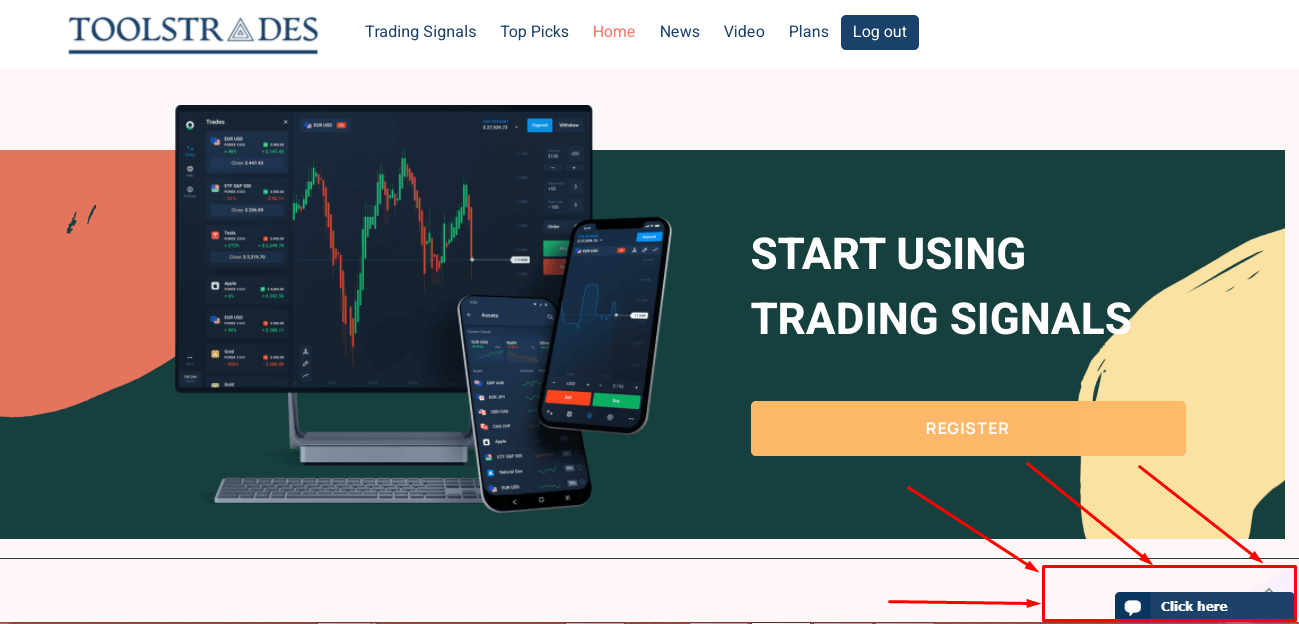

Mobile version of the website

You could use the service from your mobile device before, but now we've optimized the website and made it faster, so you can succeed as fast as possible, anywhere in the world, just from the palm of your hand on your smartphone.

New Signal Options

For your convenience and to expand your investment opportunities we have added new currency pairs and many other new assets to the signals service. Check out all the new signal options on our website.

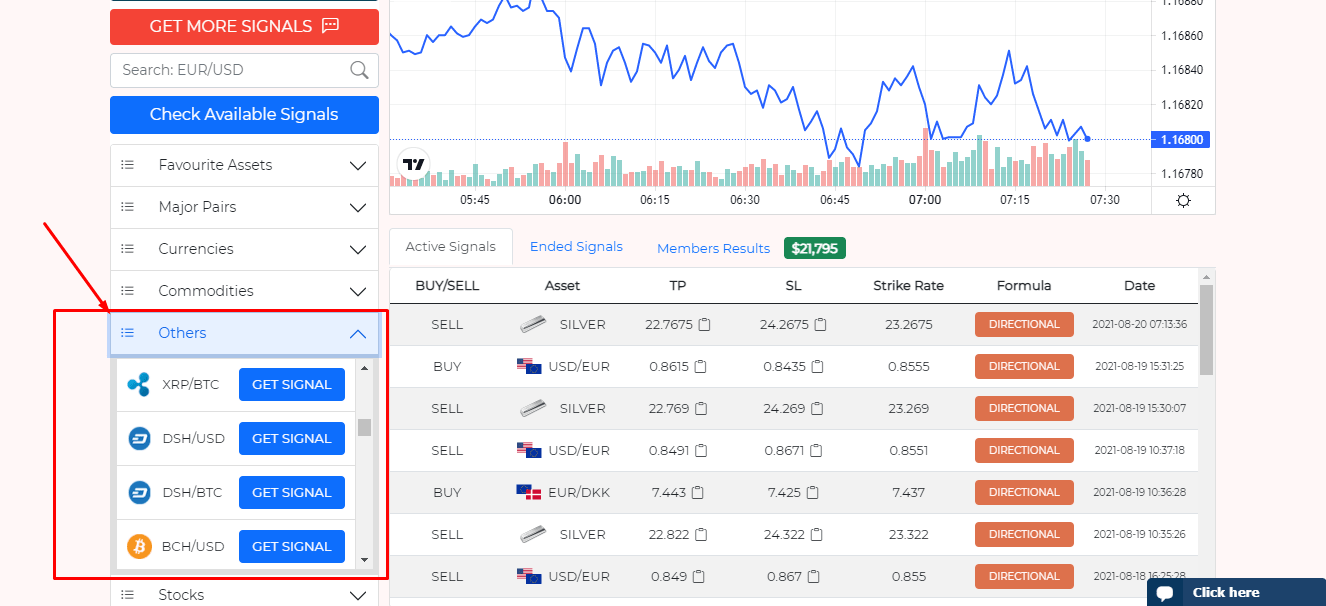

Digital Assets

We would like to make a special mention of the major upgrading of the electronic assets list. We have increased the list of available options multiple times. And now you can bravely enter the new era of digital assets trading with our service, which has proved its efficiency in more traditional markets, but now our service will confidently support you in mastering the new high-yield financial instrument, such as a wide range of digital assets. Also, our managers are always glad to help you, so feel free to write to our website chat room and get free financial consultation, or detailed instructions about our service features as well as other questions you may have.

Extended Team of Online Support Managers

We've expanded our team of online support managers, and now you can get answers to all your questions even faster. Our managers are always ready to give you a free consultation and help you develop the best strategy for your investment and success. With our service, you can reach your new horizons and heights. Do not hesitate to write into a chat on our website and support managers will always help you with the solution of your problems and questions.

AWARDS

We also want to say thank you to all our members and team members of Tools Trades, for the great work and achievements, which have been marked with many awards, which you can see below.

OUR APP

Download the Tools Trades app on your smartphone, for a full experience of all the useful features of our service. Here are the links for download from official PlayMarket for Android, and AppStore for IOS.

PRO PLANS

Become one of our successful professional members by selecting an advanced paid package to help you succeed in your goals. For more information go to this page, or chat on our website, our managers will give you all the necessary information about this option.

]]>

Gold traded with a mild positive bias through the early European session, albeit lacked any follow-through and was last seen hovering around the $1,733-35 region. The XAU/USD, so far, has struggled to capitalize on Monday's rebound from the flash crash to the lowest level since late March and has been oscillating in a range over the past two trading sessions. Concerns about the economic fallout from the fast-spreading Delta variant of the coronavirus extended some support to the safe-haven precious metal.

That said, expectations for an early tapering of the Fed's massive monetary stimulus acted as a headwind for the non-yielding gold and capped the upside. The incoming US macro data, especially Friday's blockbuster NFP report, marked another step towards the Fed's goal of substantial further progress in the labour market recovery. This, in turn, forced investors to bring forward the likely timing for policy tightening. Moreover, the Fed officials have also started to guide the market towards an early tapering of the massive pandemic-era stimulus and higher interest rates as soon as 2022.

]]> The AUD/USD pair dropped to its lowest level in nearly two weeks at 0.7316 on Tuesday but managed to stage a modest rebound ahead of the American session. As of writing, the pair was up 0.14% on the day at 0.7342. Earlier in the day, the data from Australia revealed that the National Australia Bank's (NAB) Business Confidence Index declined to -7 in July from 11 in June. This reading fell short of the market expectation of 15. Additionally, the NAB's Business Conditions Index fell to 11 from 24 and made it difficult for the AUD to find demand.

The AUD/USD pair dropped to its lowest level in nearly two weeks at 0.7316 on Tuesday but managed to stage a modest rebound ahead of the American session. As of writing, the pair was up 0.14% on the day at 0.7342. Earlier in the day, the data from Australia revealed that the National Australia Bank's (NAB) Business Confidence Index declined to -7 in July from 11 in June. This reading fell short of the market expectation of 15. Additionally, the NAB's Business Conditions Index fell to 11 from 24 and made it difficult for the AUD to find demand.

In the meantime, the US Dollar Index (DXY) continued to push higher after closing the previous two trading days in the positive territory and reached its strongest level in nearly three weeks at 93.10. Currently, the DXY is clinging to small daily gains at 93.04, not allowing AUD/USD to extend its recovery. Later in the day, the Nonfarm Productivity and the Unit Labor Costs data for the second quarter from the US will be looked upon for fresh impetus. More importantly, Cleveland Fed President Loretta Mester and Chicago Fed President Charles Evans will be delivering speeches. On Wednesday, Westpac Consumer Confidence Index data for August will be featured in the Australian economic docket.

]]> The USD/CAD pair edged lower heading into the European session and dropped to fresh daily lows, around the 1.2565-60 region in the last hour. The pair struggle to capitalize on its recent positive move beyond the very important 200-day SMA and witnessed a modest pullback from two-week tops, around the 1.2590 region touched earlier this Tuesday. Crude oil prices gained positive traction on Tuesday and built on the overnight rebound from three-week lows. This, in turn, underpinned the commodity-linked loonie and was seen as a key factor that exerted some downward pressure on the USD/CAD pair.

The USD/CAD pair edged lower heading into the European session and dropped to fresh daily lows, around the 1.2565-60 region in the last hour. The pair struggle to capitalize on its recent positive move beyond the very important 200-day SMA and witnessed a modest pullback from two-week tops, around the 1.2590 region touched earlier this Tuesday. Crude oil prices gained positive traction on Tuesday and built on the overnight rebound from three-week lows. This, in turn, underpinned the commodity-linked loonie and was seen as a key factor that exerted some downward pressure on the USD/CAD pair.

That said, uncertainty about how the COVID-19 situation in China will evolve and what this means for oil demand might act as a headwind for the black gold. China – the world's top crude oil importer – reported more COVID-19 infections on Monday in the latest outbreak of the disease. Adding to this, authorities have also stepped up mass testing to contain local transmission of the highly contagious Delta variant of the coronavirus.

]]>