After some of the wildest days on markets in recent memory, the weekend can't come soon enough for many. Panicked selling Monday and Tuesday gave way to a scramble to buy Wednesday and Thursday.

And there could be a sting in the tail Friday - U.S. stock futures are signaling all three main indexes will open about 1% lower and European markets are weaker in morning trade.

Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

1) China rallies again

The Shanghai Composite had a truly wild ride this week, losing roughly 15% on Monday and Tuesday, before mounting a major rally in the second half of the week. Friday saw gains of nearly 5% on the main Chinese index, while the Shenzhen market put in a slightly stronger performance.

The Shanghai index still suffered a 7.8% decline for the week.

Elsewhere in Asia, new data showed Japan is still struggling to lift inflation to its target of 2%. Unemployment data improved, however, and the Nikkei ended the day with a 3% gain.

2) Oil slips back

U.S. crude futures jumped 10% Thursday, but the positive tone evaporated Friday. Oil was trading nearly 1.5% weaker at $42 a barrel. That's still a big recovery from the 6-year low of $38 a barrel hit on Monday, but crude is about 20% down since the start of the year.

3) Market movers

Freeport McMoran, Facebook: Shares in mining company Freeport McMoran (FCX) jumped 12% premarket after hedge fund manager Carl Icahn disclosed he had acquired a stake. Facebook (FB, Tech30) was slipping about 0.5% premarket despite reporting late Thursday that more than one billion people logged on Monday -- the first time that milestone has been hit in a day.

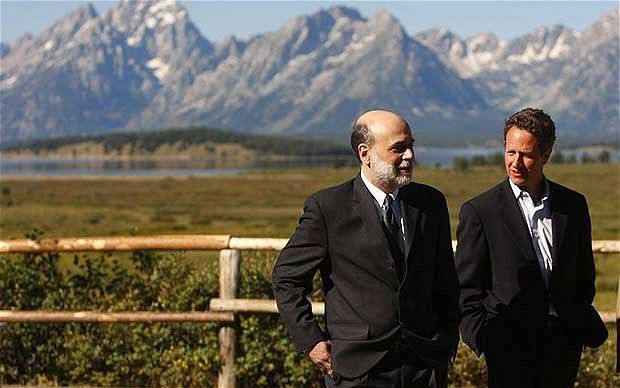

4) Central bankers huddle

Federal Reserve policymakers continue their annual meeting in Jackson Hole, Wyoming. The three-day affair is being closely watched for hints about when to expect an interest rate hike.

New York Fed President William Dudley said Wednesday the case for a September hike had become "less compelling," but the waters were muddied again Thursday by news of much stronger U.S. second quarter growth than expected.

Much of the world's economy is still hooked on cheap central bank cash, and the prospect of a U.S. rate hike has already shaken many emerging markets.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()