What is it? A positive number indicates that more goods were exported than imported. About 65% of Canadian exports are purchased by the US. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

When? At 8:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the CAD to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

1. U.S. stocks fell in early trading on Monday after Greeks overwhelmingly rejected conditions of a rescue package from creditors, throwing the future of the country's euro zone membership into further doubt.

Stock markets globally fell, but analysts said the declines were less than expected due to expectations that the European Central Bank would act to limit any damage.

The ECB's governing council is due to hold a conference call on Monday afternoon to discuss the provision of emergency funding to Greece's banks. The call was originally to be held at noon. A new bailout deal is needed for Greece to meet a July 20 deadline to repay $3.9 billion of bonds to the ECB.

2. The U.S. dollar rose to fresh two-and-a-half month highs against its Canadian counterpart on Monday, as demand for the safe-haven greenback strengthened broadly after Greek voters rejected conditions of a rescue package from creditors on Sunday.

USD/CAD hit 1.2652 during early U.S. trade, the pair's highest since April 13; the pair subsequently consolidated at 1.2650, gaining 0.62%.

The pair was likely to find support at 1.2540, Friday's low and resistance at 1.2668, the high of April 10.

3. Service sector activity in the U.S. grew at a slower pace than expected in June, one month after expanding at the weakest rate in more than a year, industry data showed on Monday.

In a report, the Institute of Supply Management said its non-manufacturing purchasing manager's index inched up to 56.0 last month, up from 55.7 in May but below forecasts for a reading of 56.2.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? Eurogroup meetings are usually held in Brussels and attended by the Eurogroup President, Finance Ministers from euro area member states, the Commissioner for economic and monetary affairs, and the President of the European Central Bank. They discuss a range of financial issues, such as euro support mechanisms and government finances. The meetings are closed to the press but officials usually talk with reporters throughout the day, and a formal statement covering meeting objectives may be released after the meetings have concluded. The Eurogroup coordinates economic policies of the 19 euro area member states, and their initiatives and decisions can have a widespread effect on the Eurozone's economic health.

When? All Day

Trading Tip: This announcement can greatly affect the EUR so make sure to follow it!

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? Manufacturing makes up around 80% of total Industrial Production and tends to dominate the market impact. It's a leading indicator of economic health - production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings.

When? At 16:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the GBP to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? The rate decision is often priced in the market so it tends to be overshadowed by the RBA Rate Statement which is focused on the future. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

When? At 12:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the AUD to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

Stock markets are making some nausea-inducing moves Monday as investors react to major developments out of Greece and China.

1. Investors seeing red:

U.S. stock futures are deep in negative territory, with investors taking their cue from Europe and Asia, where nearly all major stock markets are falling.

European stock markets are down by roughly 1% to 2% as traders react to the results of Sunday's Greek referendum. The country voted by a wide margin to reject Europe's latest bailout offer. This raises the risk that the country could now suffer a worse economic disaster and lose its place in the euro.

Yields on Greek 10-year government bonds soared to nearly 17% as investors saw an increased risk that the country will have to dump the euro. Yields on government bonds in Spain, Portugal and Italy are also rising, though the moves were modest. Bond yields in perceived safe havens like Germany and the U.S. are edging lower.

Meanwhile, Chinese stocks remained volatile, despite a series of dramatic steps by officials over the weekend that were designed to support markets.

After opening with a gain of roughly 7%, the benchmark Shanghai Composite lost steam. It closed with a gain of 2.4% Monday. The smaller Shenzhen Composite, which also started the day in positive territory, reversed course and ended 2.7% lower.

2. Keeping up with currencies:

The U.S. dollar and British pound are broadly stronger Monday morning while the euro is weaker.

Traders are reacting to continued uncertainty about Greece's future.

3. Stock market mover:

Rolls-Royce Holdings: Investors are selling shares in Rolls-Royce Holdings (RYCEY), which is one of the world's biggest manufacturers of aerospace engines. The stock is dropping by about 9% in London after the company warned about weaker-than-expected business trends in the first half of this year. The company is also halting its share buyback program.

4. Waiting for an Iran deal:

Investors are waiting for further developments out of Iran. Negotiators from Iran, the United States, China, Germany, France, Britain and Russia are trying to reach a deal to lift sanctions against Iran in exchange for assurances that the country will maintain a peaceful nuclear program.

A June 30 deadline for an agreement has come and gone, so now U.S. negotiators are hoping for a deal later this week.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

Survey of about 175 purchasing managers, selected geographically and by sector of activity to match the economy as a whole, which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

When? At 10:00am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the CAD to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy. Survey of about 400 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

When? At 10:00am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the USD to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? Above 0 indicates optimism, below indicates pessimism. Source changed series from seasonally adjusted to non seasonally adjusted as of Jul 2003. Report is only available to NZIER members.

It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

When? At 6:00pm Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the NZD to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

The euro remained moderately higher against the U.S. dollar on Friday, as investors awaited the outcome of Sunday's Greek referendum and as trading volumes were thin as U.S. markets remained closed for the Independence Day Holiday

Gold prices gained ground in European morning hours on Friday, as the release of downbeat U.S. economic reports on Thursday dampened demand for the greenback, while trading volumes were expected to remain thin with U.S. markets closed for a national holiday.

Crude oil futures fell to fresh two-month lows on Friday, as markets were still digesting news of an unexpected rise in U.S. stockpiles and as trading volumes remained thin with U.S. markets closed for the Independence Day weekend.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

In the last few days some surprising events occurred that affected the global markets as well as our signals. The NFP announcement was one of those events which came as a surprise to many, including us. The announcement fell short from the actual forecast which caused the USD to weaken, and investors around the globe to experience losses.

So far, our signals today are doing great as most of them are in the money, and the total payout is $31940.00 (see picture below).

Moreover, as you can see in our website in previous reports, our signals had much better results with 90% success rates, which only strengthen the fact that the recent days do not tell the true story.

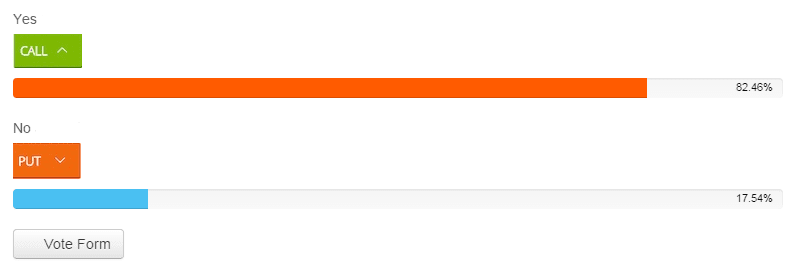

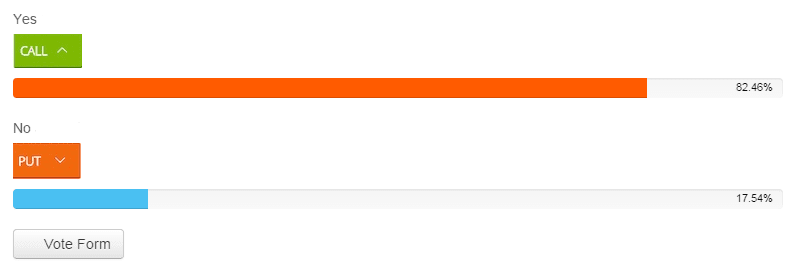

As we can see in the poll below, when our users were being asked if the USD would rise following the NFP announcement, 82% said 'Yes' while only close to 18% answered 'No'.

Lately the FOREX market was unstable and more vulnerable. But this is about to change as the Americans won’t let the USD fall, because of the 4th of July celebrations take place this Saturday. We suggest that you register to our services and get our signals to achieve better results in the next days to come.

We recommend our customers that had some bad results in the last few days, to look at the big picture and not get too caught up with them.

If we look towards the future, investors should strongly consider to get more involved in the Commodities markets, especially Crude Oil, Gold and Silver. And to remember, once the EUR and USD experience fallings, be sure to think about trading in Gold and Silver. Also, we recommend to invest in a Stock or Commodity if you sense a serious movement up or down.

Speak with our representatives and trade with better results starting now!

Signals Binary staff wishes you a happy 4th of July!

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

Gold prices rebounded from more than three-month lows on Thursday after data showing that the U.S. economy added fewer jobs than expected last month tempered expectations for higher interest rates.

Gold futures for August delivery were last at $1,164.7 a troy ounce, off the day’s lows of $1,158.2.

The dollar turned broadly lower after the Labor Department reported that the U.S. economy added 223,000 jobs in June, compared to expectations for jobs growth of 230,000.

U.S. stocks rose on Thursday after data showed job growth slowed in June, indicating that the U.S. Federal Reserve might hold off on raising interest rates in September.

Eight of the 10 major S&P 500 sectors rose, with the utilities index <.SPLRCU> leading the gains with a 1.5 percent rise.

Nonfarm payrolls increased 223,000 last month, below the 230,000 that economists polled by Reuters had expected.

The dollar fell against a basket of other major currencies on Thursday, after data showed that he U.S. economy added fewer jobs than expected last month data, dampening expectations for a rate hike.

The Labor Department reported that the economy added 223,000 jobs in June, compared to expectations for jobs growth of 230,000. May’s figure was revised down to 254,000 from 262,000 previously.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? It's positively correlated with interest rates - early in the economic cycle an increasing supply of money leads to additional spending and investment, and later in the cycle expanding money supply leads to inflation. Survey of about 300 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

When? At 3:15am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the EUR to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy. Survey of purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

When? 4:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the GBP to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

1. Jobs report:

The health of the U.S. economy takes center stage today. June employment and wage figures are due out at 8:30 a.m. ET, one day early thanks to the July 4 holiday.

But pay close attention to the wage figures. Average hourly wages are likely to hold pretty steady at 2.2%, well below the Federal Reserve's 3.5% target. The jobs report is key for the Fed in deciding whether or not to hike interest rates for the first time since the recession began.

2. Greece groans:

Just days before a referendum that is likely to decide the country's future in the eurozone, there are still plenty of surprises coming out of Greece.

European lenders were unmoved Wednesday by the Greek government's surprise bailout U-turn, saying they won't consider any proposals before Sunday's vote.

The International Monetary Fund confirmed that the bankrupt country remains locked out of more support until it pays $1.7 billion owed.

3. China stocks:

Another day, another wild ride for Chinese stocks. The Shanghai Composite closed down 3.5%, while the smaller Shenzhen Index lost 5.6%. Investors in China are getting used to plenty of volatility, despite efforts by Beijing to stabilize the market.

4. Earnings updates:

Food maker McCormick (MKC) and Bassett Furniture (BSET) will release their latest quarterly earnings before the open. Family Dollar (FDO) will report after the close.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy.

When? At 8:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the USD to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

What is it? As head of the ECB, which controls short term interest rates, he has more influence over the euro's value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

When? At 11:10am Eastern Time.

Trading Tip: If the announcement will hint towards higher interest rates, you can expect the EUR to rise.

Ask us about our FREE financial advice program:

Other Top Stories:

Will Twitter's Share Crash?

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

![]()

![]()